Mathematics | Free Full-Text | Dominance-Based Decision Rules for Pension Fund Selection under Different Distributional Assumptions

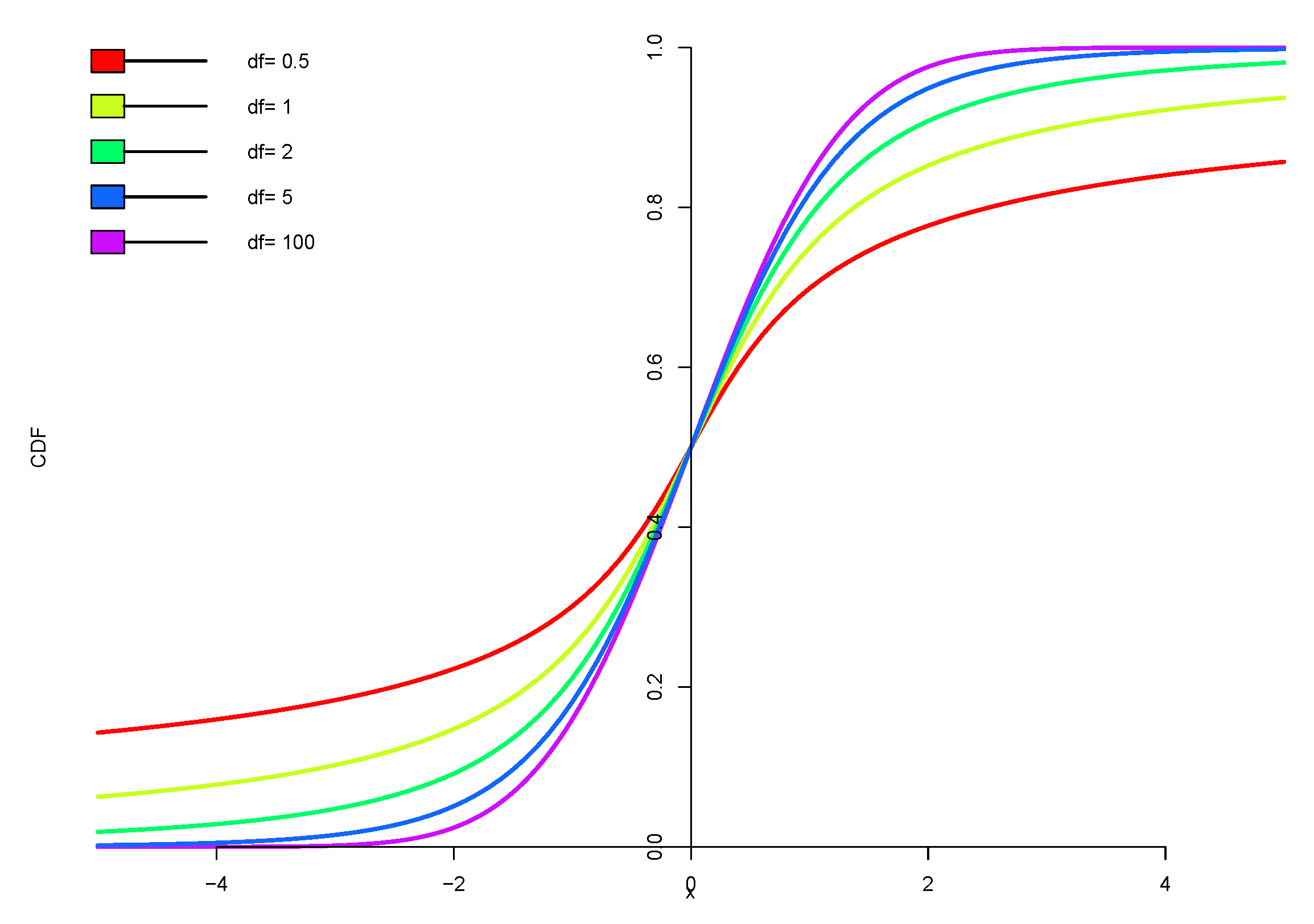

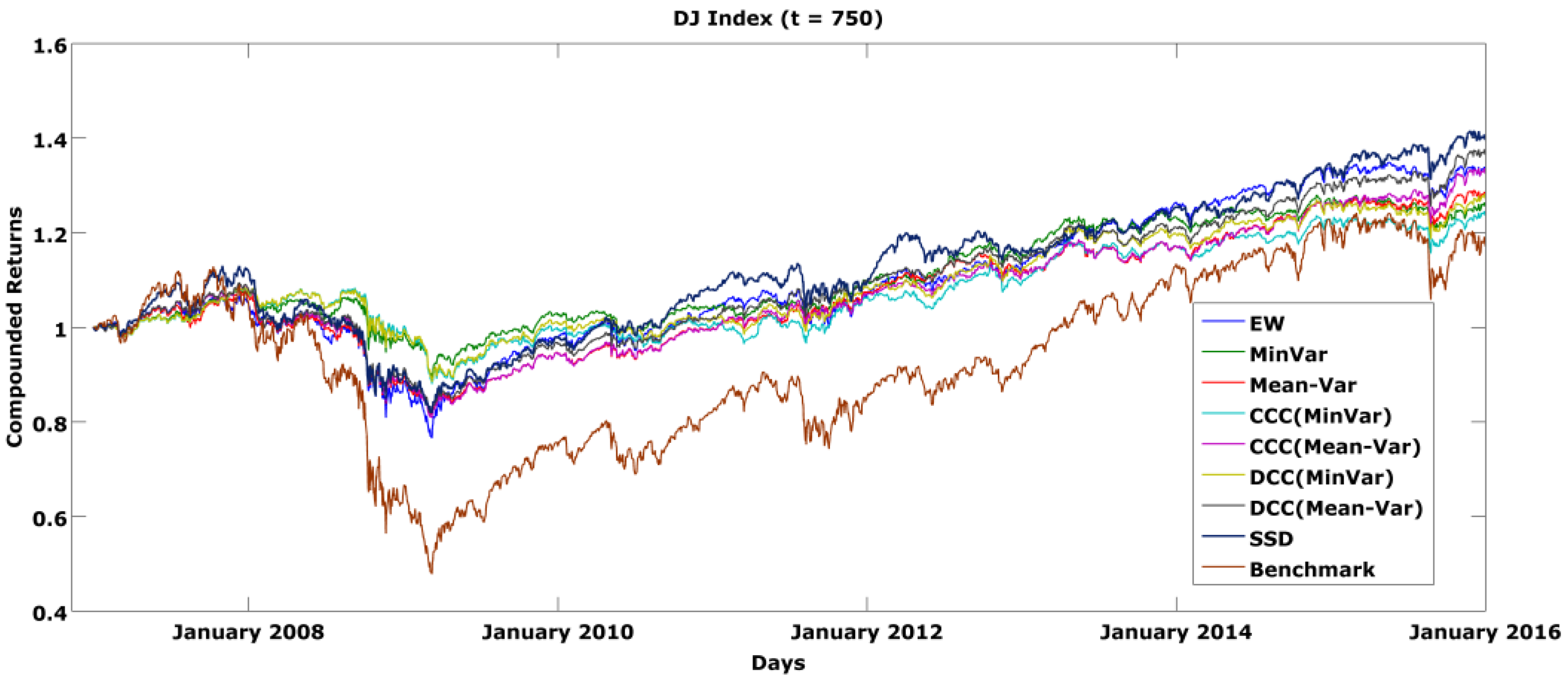

JRFM | Free Full-Text | Portfolios Dominating Indices: Optimization with Second-Order Stochastic Dominance Constraints vs. Minimum and Mean Variance Portfolios

cvar - How to prove the following relation of Conditional Value-at-Risk and Value-at-Risk? - Quantitative Finance Stack Exchange

PDF) Enhanced Index Tracking with CVaR-Based Measures | Włodzimierz Ogryczak, Gianfranco Guastaroba, and M.Grazia Speranza - Academia.edu

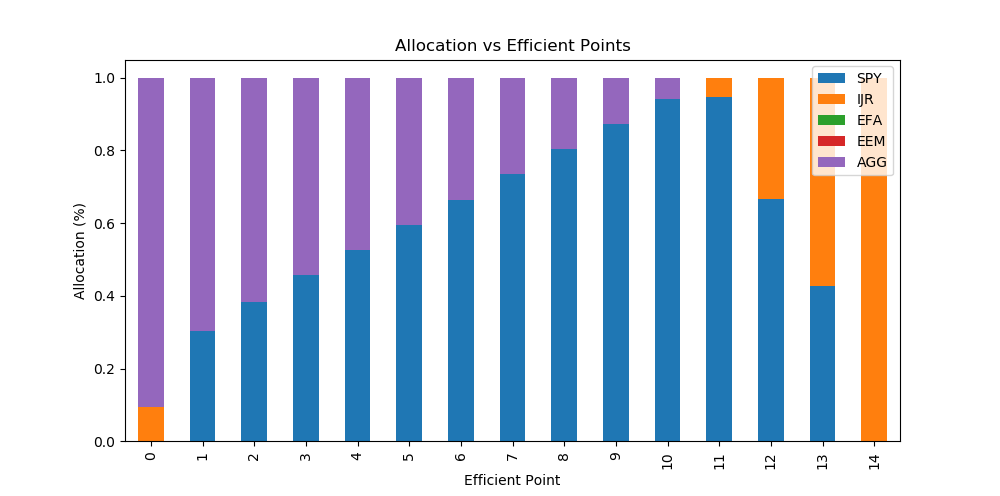

Out-of-sample downside risks from (SSD), (RSSD) (for λ = 0.2), (MM),... | Download Scientific Diagram